Volatility Shares, the issuer of UVIX, announced a 1 for 5 reverse split effective January 25, 2023.

What’s UVIX?

UVIX is a 2x leveraged long VIX Futures ETF, which works almost identically to UVXY, with the 2x leverage factor being the key difference.

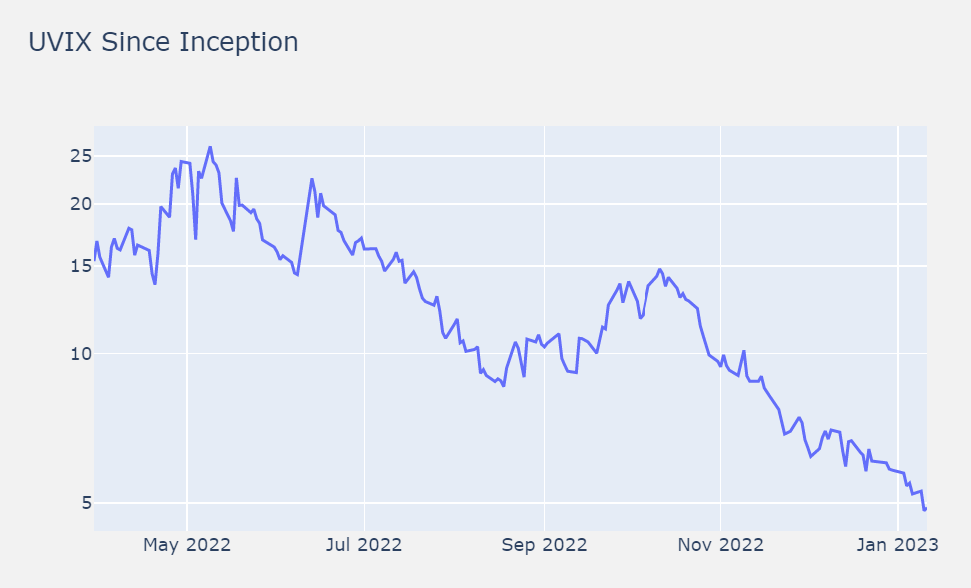

UVIX was launched at the end of March 2022, and started trading at $15.00. Since then, despite the significant stock market decline of 2022, its value has fallen to below $5.00.

Unfortunately, this is the long-term expected behavior of a long volatility ETF. Therefore, their issuers announce reverse splits all the time.

What is a reverse split?

Most investors and traders know stock splits, i.e., a company issues new shares to current shareholders. This is usually done after a significant increase in the share price, in order to make it more “tradeable” (lower $ amount per share).

The value of an investor’s investment will not change. Instead of holding 1 share at $500, they will have 5 shares at $100.

A reverse split is the opposite. Regarding UVIX, the issuer will convert 5 current shares into 1 new share. As a result, the price of UVIX will quintuple (for example, from $5 to $25). Again, the value of an investment is not affected by a reverse split.

How does the reverse split affect UVIX options?

Option contracts will be adjusted automatically. Let’s look at what is going to happen to a UVIX $5 Call expiring on February 17, 2023.

This contract gives the buyer the right to buy 100 shares of UVIX at $5. After the 1 for 5 reverse split, the contract will give the right to buy 20 shares at $25.

This adjustment of option contracts will not affect the value of the option contract. If UVIX is up 20% versus strike at expiration, the original option will pay ($6 – $5) * 100 = $100, and the adjusted option will pay ($30 – $25) * 20 = $100.

However, the trading volume of the original option contracts will become quickly illiquid. Therefore, it is highly recommended to roll existing option positions to new contracts after the reverse split.

How is UVIX doing versus its peers?

As predicted, UVIX has been a successful addition to the range of volatility ETFs, as it offers the highest leverage factor.

Relative to UVXY, the daily trading value of UVIX accounts for around 20% of that of UVXY.

UVIX options, however, are still quite illiquid, particularly in-the-money and out-of-the-money strikes.

Will there be more reverse splits in the future?

Most definitely! The powerful forces of contango and leverage decay will keep eating away the assets invested in long VIX futures ETFs and ETNs.