Last update: February 24, 2022

Volatility junkies love UVXY for its potentially enormous returns over very short periods of time.

Large UVXY returns can be positive (“spikes”) or negative (“declines”).

Details about the data used:

- UVXY’s inception date is October 3, 2011. Initially, UVXY’s leverage factor was 2x, but was reduced to 1.5x effective February 28, 2018 (see the history of volatility ETFs for why this change was made).

- Therefore, data prior to the leverage factor change, were adjusted to 1.5x leverage.

- Furthermore, VIX futures started trading on March 26, 2004, which provides the inputs to calculate UVXY prices prior to its inception at 1.5x leverage.

- All spikes and declines are calculated based on daily close prices.

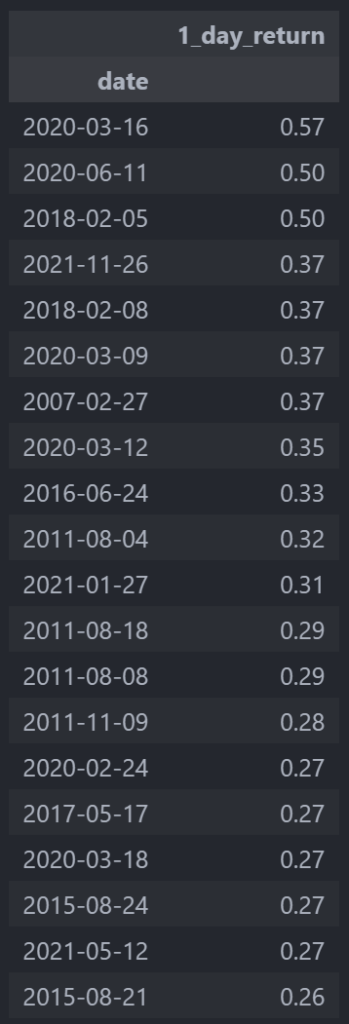

Largest UVXY 1-Day Spikes

March 16, 2020 (COVID-19 panic) still holds the record (57% up) for the largest 1-day UVXY spike, closely followed by June 11, 2020 (Delta strain of COVID-19) and February 5, 2018 (Volmageddon).

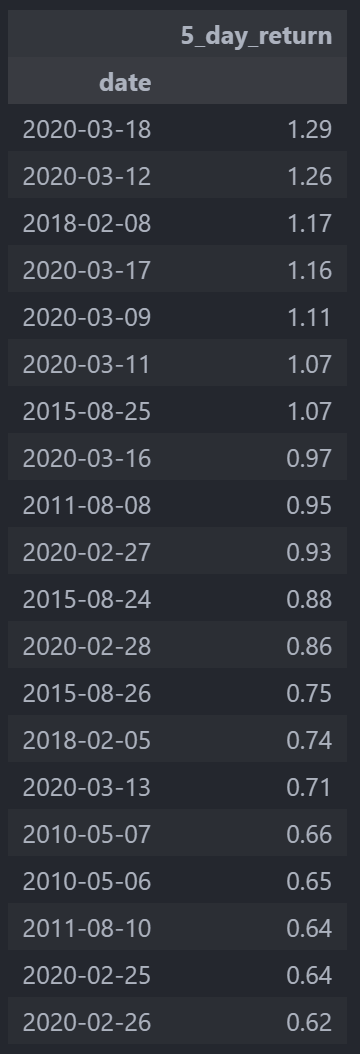

Largest UVXY 5-Day Spikes

Not surprisingly, many of the largest UVXY spikes over a period of five days occurred in March 2020, when markets were in shock about the impact of COVID-19 on the economy.

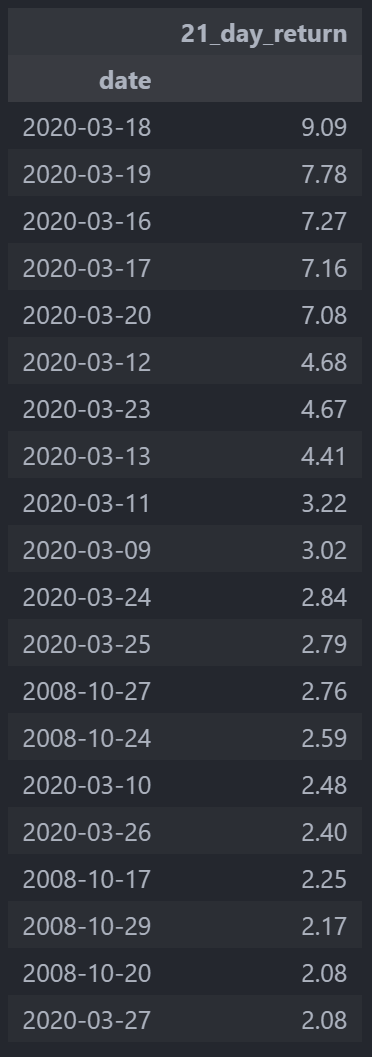

Largest UVXY 21-Day Spikes

The situation is similar for the largest UVXY spikes over the course of a full month (= 21 trading days). Most spikes occurred in March 2020, but there is also a strong showing of dates from fall 2008 when the Global Financial Crisis was crashing stock markets all over the world.

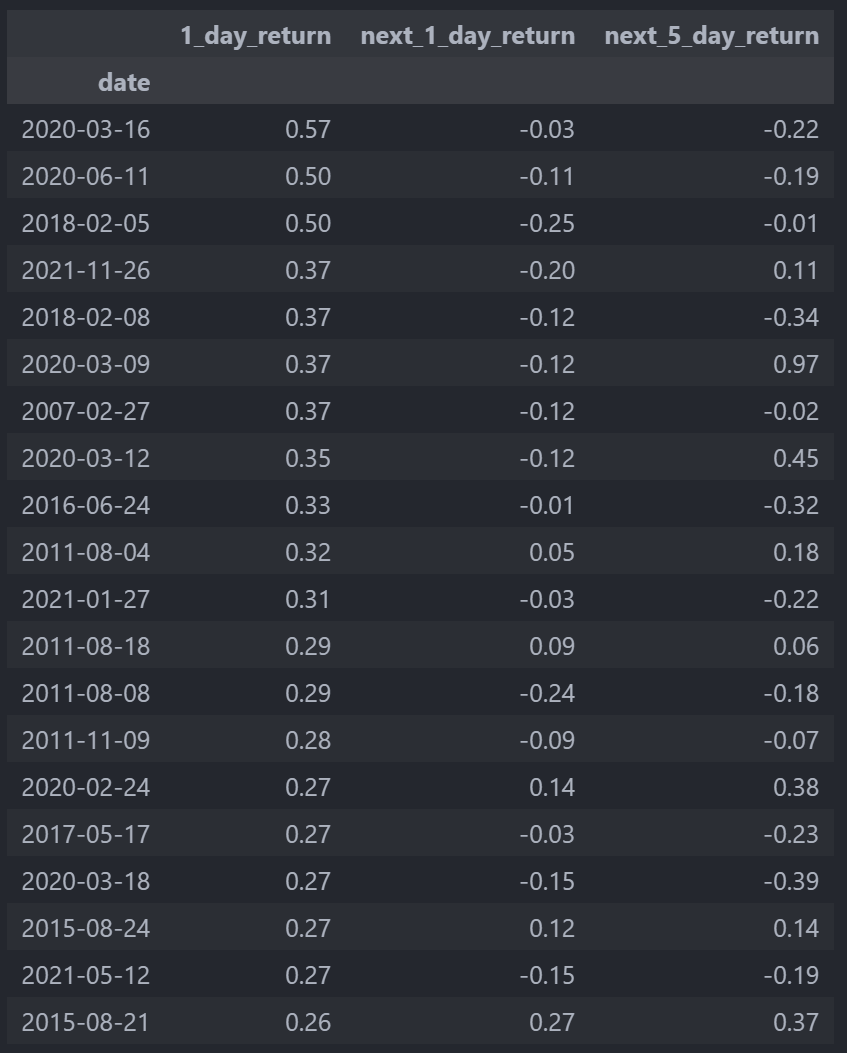

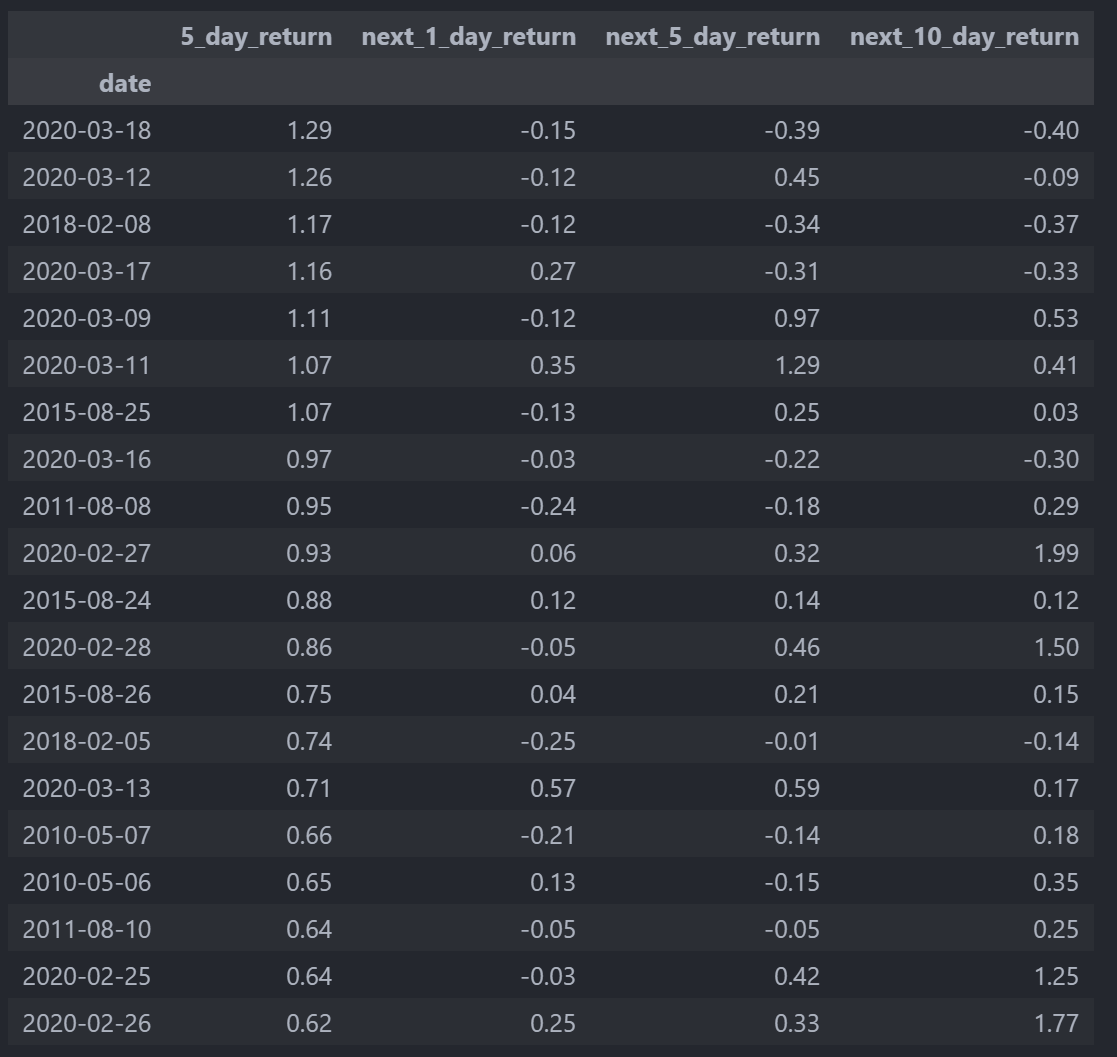

What To Expect After A Large UVXY Spike?

Knowing that UVXY is prone to large spikes is great but do these spikes have any predictive value?

Let’s explore what happened after the biggest 1-day spikes.

- The larger the 1-day spike, the safer it appears to bet on a next-day reversal.

- However, there is a good chance that UVXY continues its upward trajectory the next day.

After a large 5-day spike, the future is less clear. Considering the returns over the next 1, 5 or 10 days, there is no clear picture.

- After a “sustained” move (i.e. five days instead of just one or two days), there may be a reversal. But there is also a high chance that UVXY continues moving upward.

- Looking at the dates in the table, there are mainly major volatility events such as COVID-19 in 2020, the Euro crisis in 2011 and China growth concerns in 2015.

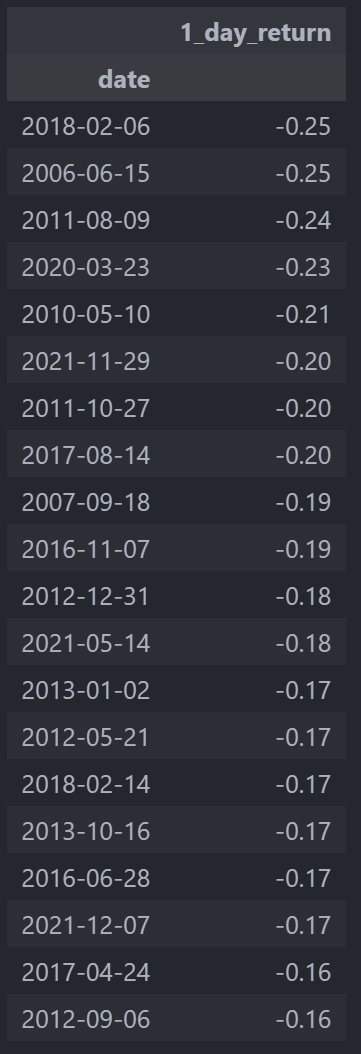

Largest UVXY 1-Day Declines

A close look at the largest 1-day declines makes it obvious that large UVXY spikes are often followed by large declines.

The magnitude of the declines is smaller relative to that of the spikes – but a daily decline between 15% and 25% is significant.

Note that an alternating sequence of large spikes and large declines results in leverage decay (also known as beta slippage), which leads to a permanent reduction in the value of UVXY’s net assets.

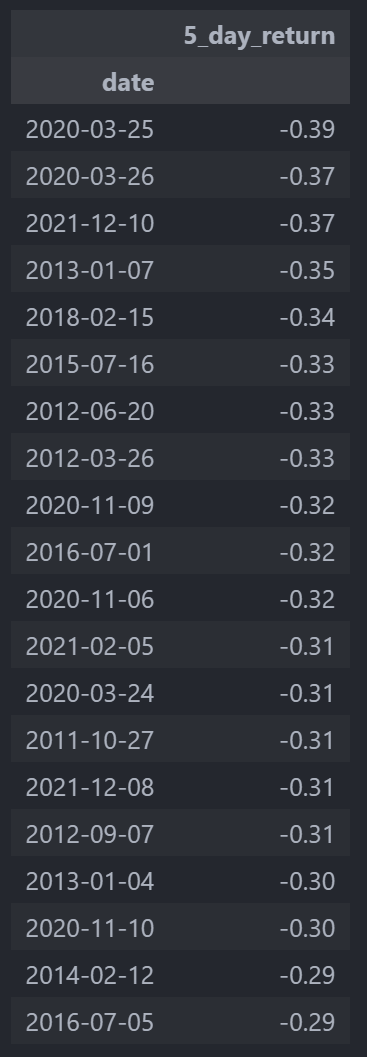

Largest UVXY 5-Day Declines

A lot of years had occurrences of 30-40% losses over five trading days.

Largest UVXY 21-Day Declines

There were 20 events in UVXY’s short lifespan when UVXY lost 45% to 60% of its value in a month.

It is always shocking to see this list! Not surprisingly, ProShares, the issuer of UVXY, strongly warns against holding a long UVXY position for an extended time period.