VXX, UVXY, and other long volatility ETFs / ETNs can produce enormous losses during non-volatile periods. More often than not these losses occur during periods of sideways VIX moves (when one would expect a long volatility ETP not to lose any money).

The reason for these losses? Contango!

The purpose of this article is to …

- Define contango in the context of VIX

- Explain how long volatility ETFs / ETNs invest

- Demonstrate how these investments are vulnerable to contango

- Show real-life examples how contango destroys the value of UVXY

What is contango?

Contango describes a situation where the price of a futures contract is higher than the spot price.

The chart below shows how the VIX futures term structure looked like on October 8, 2021. On this day, the VIX futures were in contango:

- Spot VIX (= the widely reported VIX level) closed at 18.77.

- The nearest month VIX future (October) expires in around ten days and closed at 19.72.

- The November VIX future closed at 21.61, and the following months even higher.

It is important to understand what happens as these contracts approach expiration while they are in contango. The next chart shows the VIX futures term structure on October 13, 2021.

- Spot VIX was almost unchanged vs October 8 and closed at 18.64.

- The October VIX future had dropped from 19.72 on October 8 to 19.15.

- Similarly, the November contract had moved from 21.61 to 21.11.

Assuming that the level of spot VIX is staying at 18.64, the October VIX future expires at exactly that level, while the other contracts also converge towards spot.

This converging towards the spot price as expiration approaches reduces the value of a long volatility ETF or ETN.

Contango is the opposite of backwardation. A futures market is in backwardation when the futures price is lower than the spot price.

A more thorough description of contango and backwardation can be found on Investopedia. The Investopedia article includes some hints why futures term structures can be in contango or backwardation.

As far as VIX futures are concerned, contango is much more frequent than backwardation. Between 2006 and 2021, the one-month VIX future (see below) was higher than spot VIX in 82% of trading days.

Long volatility ETFs / ETNs hold long VIX futures positions

Contrary to common belief, long volatility ETFs do not invest in spot VIX, as spot VIX cannot be traded. Instead, these ETFs and ETNs track the daily returns of a one-month blend of VIX futures.

This blend of VIX futures (the nearest and the second-nearest for VXX and UVXY) is adjusted every day to keep the weighted time to expiration at exactly one month.

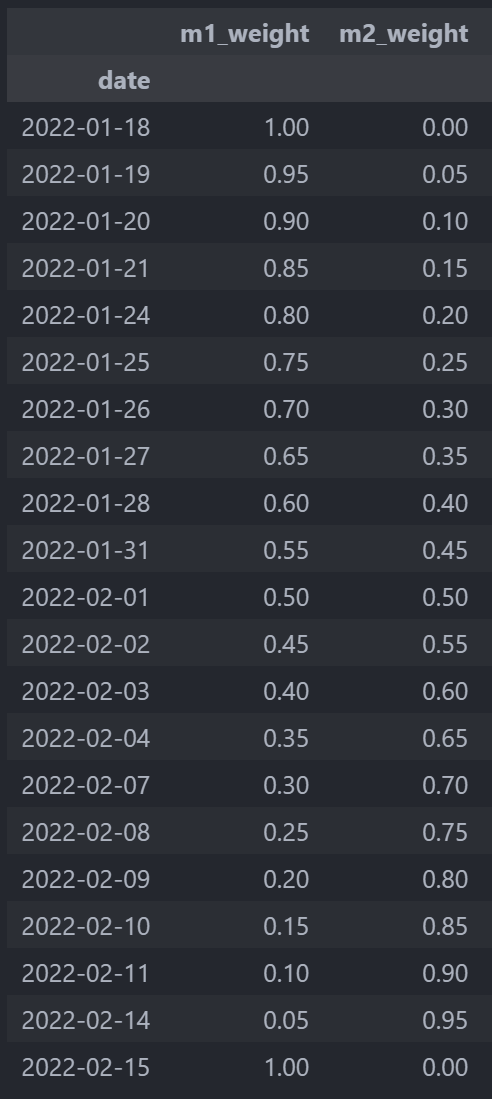

The table below shows how the daily adjustments (also known as rebalancing or rolling) play out.

- On January 18, the weight of the nearest month VIX future (February contract) is 100%.

- On January 19, 5% of the nearest month VIX future are sold, and 5% of the second nearest month VIX future are bought.

- This daily rebalancing continues, with the long volatility ETF holding different weights of M1 and M2 futures in order to keep the average time to expiration constant at one month.

- On February 15 (the day before expiration of the February contract), all holdings of the February contract are gone. The ETF’s assets are 100% in the March contract, and the process of daily rebalancing continues as described here.

Many volatility ETPs publish their holdings of VIX futures every day:

Daily rebalancing does not affect the value of long volatility ETFs / ETNs

Most volatility novices – and even a lot of advanced volatility traders – believe that the daily rebalancing is the cause of long volatility ETF / ETN losses.

Their rationale is that the daily rolling from nearest month VIX futures contract to second nearest contract equates to “selling low and buying high” in a contango situation.

Checking the math – with apples and pears

Let’s assume apples cost $2 per piece and pears cost $1 per piece. Peter has 20 pears, which are worth $20.

He sells 10 pears for $1 per piece (“selling low”) and buys 5 apples for $2 per piece (“buying high”). His portfolio of fruits is still worth 10 x $1 + 5 x $2 = $20.

As this basic example demonstrates, rolling assets from one fruit to another does not change the value of the portfolio.

Checking the math – with VIX futures

Let’s assume the nearest month VIX future is priced at 20 and the second nearest month contract at 21.

Let’s further assume that our long volatility fund is 100% invested in the nearest month and manages assets worth $100,000,000.

The contract multiplier of a VIX futures contract is $1,000, i.e. the value of one VIX futures contract is 1,000 times the quoted price.

Therefore, the fund manager can buy exactly 5,000 first month contracts (labeled “m1” in the table below).

On the second day, the fund manager sells 250 first month contracts at 20, and buys 238 second month contracts (labeled “m2”) at 21. As fractional contracts cannot be traded, there is now a small cash position.

The fund value after the second day rebalancing is still $100 million. Check yourself by calculating 4,750 x 20 x 1,000 + 238 x 21 x 1,000 + 2,000.

Therefore, the daily rebalancing does not affect the value of VXX and UVXY.

Note that the prices of m1 and m2 contracts did not change. The value-eroding effect of contango will be explored in the next section!

Simulation how contango reduces the value of a long volatility ETF / ETN

Now, let’s move on to a situation where the VIX futures term structure is in contango throughout an entire month and contracts go down in price every day.

Let’s make the following assumptions:

- A long volatility fund is 100% invested in the first month contract on the first day.

- Over the following days, the fund sells first month contracts and buys second month contracts to keep the average time to expiration at precisely one month.

- The VIX is always at 18.

- The first month contract moves from 20 to 18 (and expires), and the second month contract moves from 22 to 20.

Using the above assumptions, the long volatility ETF / ETN loses 9.5% in a month. Even though the spot VIX was unchanged, the long volatility fund experienced a significant loss.

The monthly loss would have been even higher if the level of spot VIX had been declining over the course of the month.

This simulation mirrors a 1x leveraged long volatility fund. An ETF with more leverage (for example, UVXY is 1.5x leveraged) will lose more, as a larger number of VIX futures relative to the fund value is exposed to daily declines.

Real-life examples of the destructive power of contango

Let’s look at a couple of examples showing contango in action!

October – December 2021

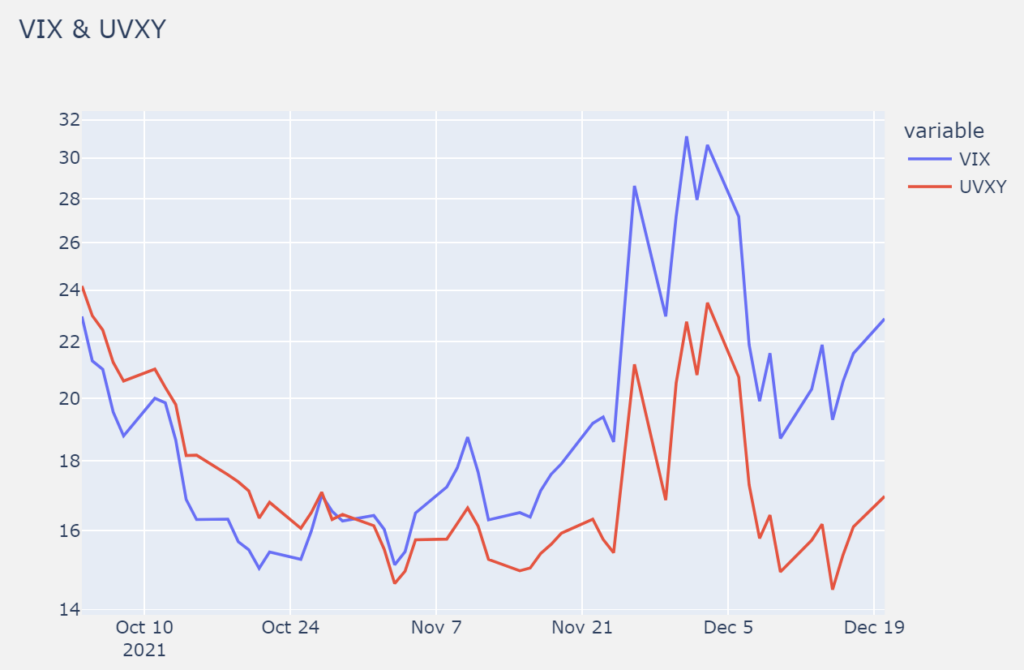

From October 4, 2021 through December 20, 2021 the VIX was moving sideways in a range between 16 and 22. There was a VIX spike after Thanksgiving, caused by the newly discovered and quickly spreading Omicron mutation of COVID-19.

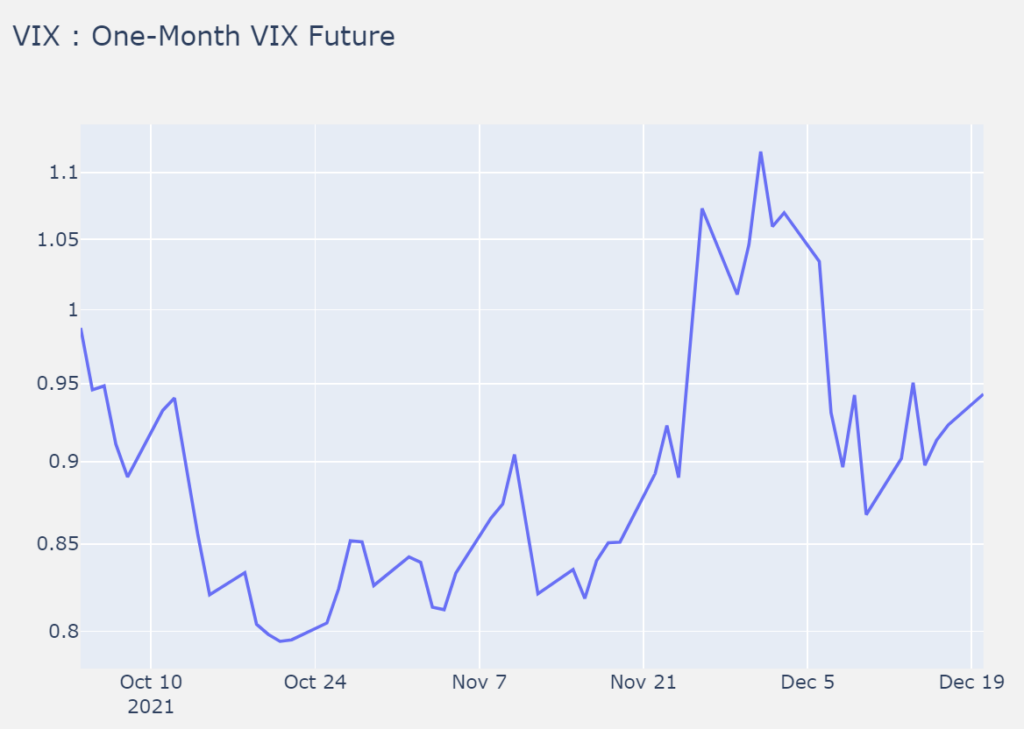

The first chart shows the level of spot VIX divided by the one-month blend of nearest and second nearest VIX futures. A number below 1 means that VIX futures are in contango and can travel towards spot.

Throughout the observed period, VIX futures were in contango most of the time. Except for the post-Thanksgiving spike, spot VIX was typically 5-20% below the level of the one-month blend of VIX futures.

The second chart shows both UVXY and spot VIX over the same period. Note that the level of spot VIX on October 4 and December 20 was almost identical. Still, UVXY dropped from $24.17 to $16.95.

2017: The Year of No Volatility

2017 is remembered as the year without volatility in the stock market. Donald Trump had just become US President and was working on his tax reform, which was unveiled as the “Tax Cuts and Jobs Act” on December 22, 2017.

While waiting for the tax reform, the stock market climbed in tiny moves, and the VIX reached its historic intraday low at 8.56 on November 24 and its historic close at 9.14 on November 3.

Not surprisingly, 95% of all trading days in 2017 saw a VIX level below the one-month blend of nearest and second nearest VIX futures.

This contango situation dealt a significant blow to UVXY as the next chart shows. Given the reverse splits since 2017, the close price of UVXY was adjusted to $50 for the first trading day of 2017 to arrive at a meaningful display of both UVXY and VIX.

While VIX was fluctuating between 9 and 13 for most of the time, UVXY declined from $50 to $3.40.

Needless to say that the prospectus of UVXY clearly warns against holding a long position for an extended period of time!

Many volatility ETF novices believed in 2017 that UVXY, TVIX and VXX could not fall any further as the VIX was hovering slightly above its all-time low. This belief was absolutely wrong. Hopefully, the diligent reader of this article will not fall for a similar misconception.

Conclusions

The combination of contango and stable/declining VIX levels makes VIX futures converge towards a lower-priced spot VIX. This is the reason for the steep losses of long volatility ETFs and ETNs such as VXX and UVXY during quiet market periods.

Leverage decay (also known as beta slippage) is another cause of losses. However, the impact of leverage decay related losses is usually significantly lower.