What happens to options after reverse splits of UVIX, UVXY and VXX?

Long volatility ETFs and ETNs go through reverse splits regularly. What causes the need for a reverse split? Most of the time, VIX futures are …

Long volatility ETFs and ETNs go through reverse splits regularly. What causes the need for a reverse split? Most of the time, VIX futures are …

Volatility Shares, the issuer of UVIX, announced a 1 for 5 reverse split effective January 25, 2023. What’s UVIX? UVIX is a 2x leveraged long …

Last update: October 11, 2022 VXX Used To Be The Favorite Of Volatility Traders VXX was the first volatility ETF/ETN product (inception date: January 30, …

Recently the rumor mill has been going wild with speculation about the introduction of SVIX and UVIX. According to SEC filings (latest filing date: January …

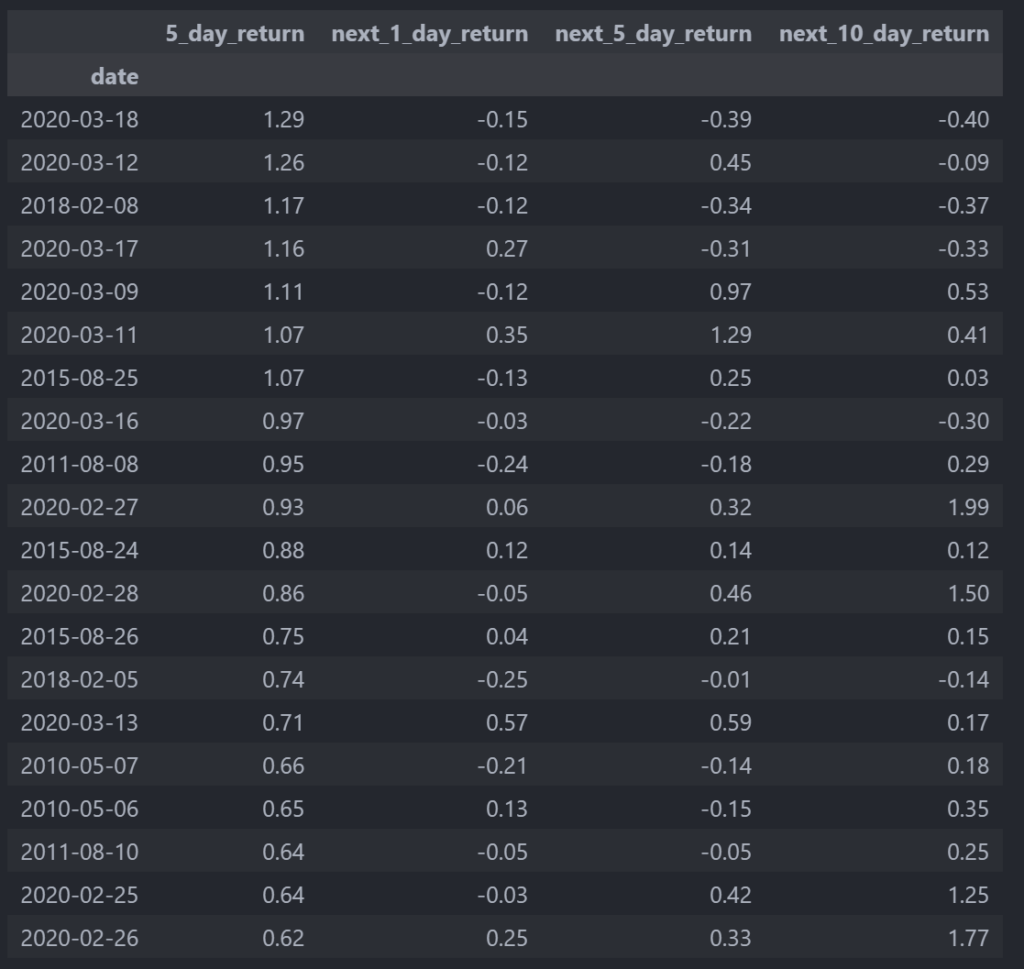

Volatility ETF junkies love 1.5x leveraged UVXY for its spikes. So what is reasonable to expect for a UVXY spike? Never Trust Any Predictions UVXY …

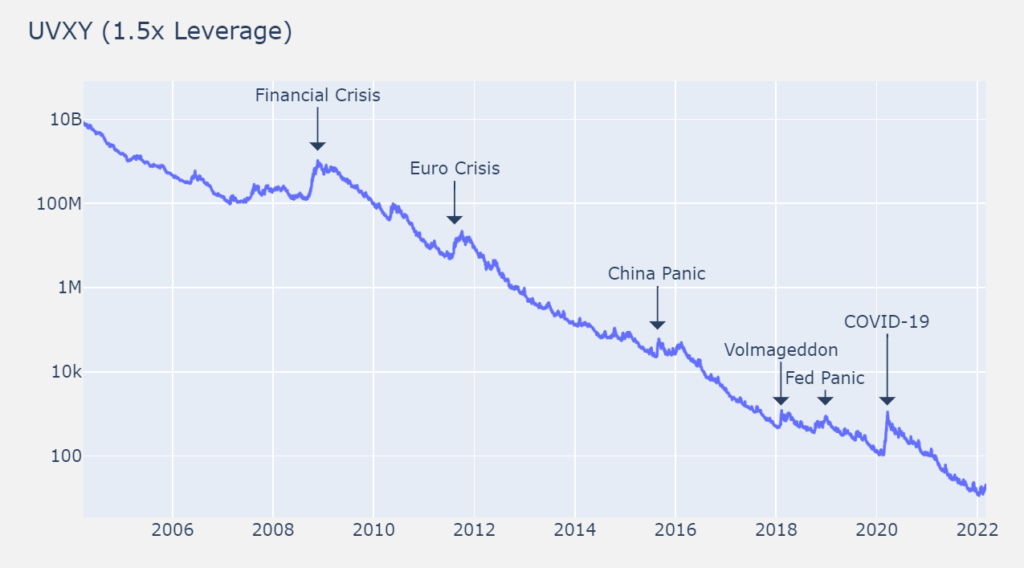

UVXY, the highly popular ETF tracking VIX futures, is a complex financial product. Its issuer warns for good reasons that UVXY has been “designed for …

Last update: January 12, 2023 Since the launch of VXX on January 30, 2009 (read more on the history of volatility ETFs and ETNs), quite …

Last update: February 24, 2022 Volatility junkies love UVXY for its potentially enormous returns over very short periods of time. Large UVXY returns can be …

VXX, UVXY, and other long volatility ETFs / ETNs can produce enormous losses during non-volatile periods. More often than not these losses occur during periods …

The decay caused by leverage is also known as beta-slippage. These terms refer to a relatively simple mathematical concept and explain why leveraged volatility ETFs …

One of the few great places to learn about volatility ETFs and ETNs such as SVXY, VXX and UVXY.